About us

CoinDepo - #1 in the Industry

CoinDepo Lending Protocol

The Combined Power of CeFi and DeFi Lending Pools

CoinDepo is the first to offer unique types of secured loans and microloans, allowing users to borrow cryptocurrencies and stablecoins without collateral.

In addition, we offer a crypto deposit service (compound interest accounts) with high interest rates.

To date, CoinDepo has a long history of successful partnerships with leading microfinance providers in emerging and fast-growing markets. By leveraging high-yield loans, CoinDepo generates stable, high returns on its assets and successfully implements crypto earning programs with attractive, competitive interest rates for its users.

CoinDepo employs a unique borrower approval process that is fully compliant with KYC and AML requirements.

During this process, borrowers undergo extensive vetting and are approved by the Board of Independent Accountants and the Accounting Guarantors. Guarantors provide liquidity to the platform as additional collateral for loans granted by liquidity providers (a loan overcollateralization mechanism).

For CoinDepo users who are liquidity providers, the Loan Overcollateralization Mechanism eliminates all risk of loss of deposited assets.

In the event of a borrower's default, they will be reimbursed for their investments and earned interest from the guarantors' funds held in CoinDepo Liquidity Reserve Accounts.

CoinDepo is currently implementing a combined CeFi and DeFi lending protocol that offers unparalleled market advantages to all platform users, both borrowers and liquidity providers.

Unlike other crypto lending platforms, CoinDepo allows borrowers to obtain collateral-free crypto loans in CeFi and DeFi lending pools. Liquidity providers can track all CoinDepo lending transactions on the blockchain and earn high-yield interest without risking the loss of their deposits, thanks to the Loan Overcollateralization Mechanism and the pools' rebalancing algorithm.

Why is CoinDepo number 1?

CoinDepo is the world's first to develop unique "Earn & Borrow" products for digital assets.

High yield profit

6 types of compound interest accounts

Solutions for institutional and VIP clients

Maximum security for your assets

Borrowing without collateral

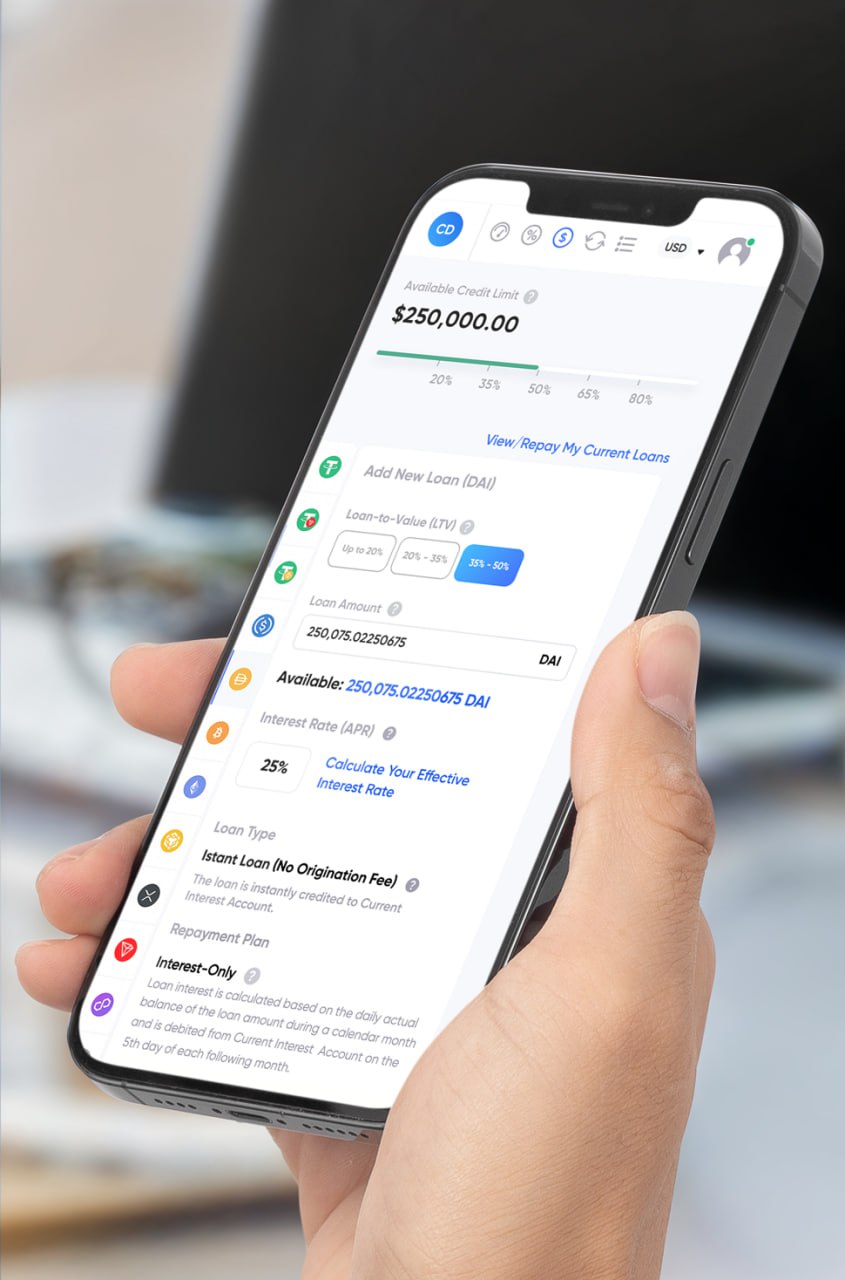

Instant line of credit

Microcredit without collateral

Credit card with crypto cashback up to 8%